Collaboration, flexibility and honesty drive our advice and service.

Frontier Advisors provides institutional investors with the strategic insights, creative thinking and state-of-the-art technology they need to optimise the growth of their portfolios while meeting the challenges of governance and risk management.

Pure advice and technology is all we focus on. Our lack of product conflicts mean our clients know they have a true partnership model with Frontier Advisors and that our interests are aligned.

Asset allocation

We believe asset allocation decisions have the greatest impact on portfolio outcomes and are key to achieving investment objectives.

Our strategic asset allocation process is tailored to every client and takes into account specific circumstances including the purpose of the assets, regulatory and competitive environment, liquidity requirements and tax status. We compliment this with a dynamic approach to positioning, that allows for the current market environment, to manage risk and add value. Frontier Advisors provides dynamic asset allocation advice across a range of asset classes and geographies. We are continuously researching and reviewing views and have a structured quarterly market outlook process and regular market updates.

Our process is also fully transparent, with our underlying modelling available through our Partners Platform technology to encourage active interaction and interrogation of the analysis for the ultimate aim of optimal outcomes for our clients.

Capital markets insights

Frontier’s capital markets assessments power our advice across many areas. Our experienced team members visit major policy making institutions, central banks, fund managers, investment banks, research houses and key industry groups from around the globe, to test, refine and enhance opinions. We read extensively and undertake large amounts of quantitative analysis and proprietary modelling. Additionally, we harness the investment expertise of our GIRA partners to exchange ideas and insights.

Investment governance

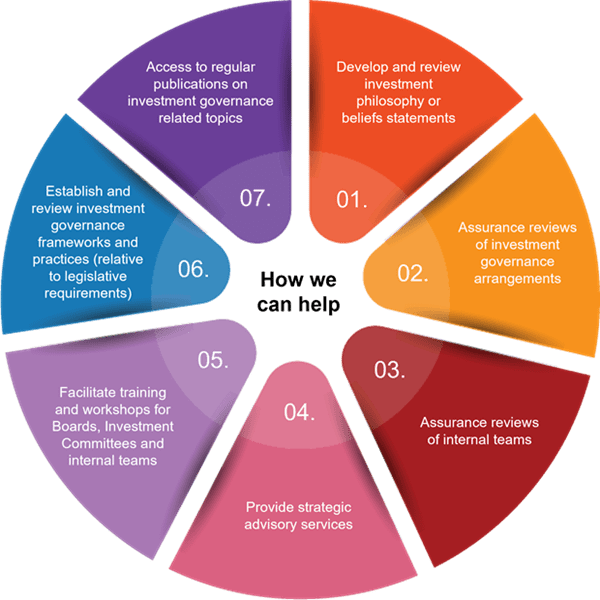

Frontier Advisors has a long and rich history in investment governance with extensive practical experience in dealing with investment governance and operating model related matters. Investment governance is the foundational framework that guides organisational decision-makers, providing a process for overseeing and making investment decisions.

Frontier is an unconflicted adviser and has 30 years of experience working with and observing institutional asset owners of varying sizes and degrees of complexity. Our overarching philosophy is one of ‘fit for purpose’ to enable institutional asset owners to succeed now and in the future.

Our Investment Governance Team provides tailored advice to help clients achieve clarity on their investment philosophy/process, establish investment beliefs, and implement and review investment governance models. This includes decision making, strategic issues and risk management. Additionally, our team has experience in conducting trustee and executive training and workshops.

More recently, our team has focused on assisting clients navigate the impact of significant regulatory changes. Valuation governance has been a key focus for many of our regulated clients. We offer a range of services to assist clients in meeting their valuation governance requirements and adopting best practices.

Investment policy

Assisting clients review their investment objectives and policies sits at the core of the success we have helped our clients deliver over many years. Our experience has helped clients negotiate over 30 years of cycles, challenges and opportunities.

Well defined objectives are the critical first step in understanding what the investor wants to achieve. Once set, the investment objectives dictate the strategy – the key component of the portfolio’s return outcomes.

Risk is the other side of the return coin. And, under normal circumstances, investors need to take risk to earn return. The balancing act is delicate. We ensure clients understand how and where risk can manifest itself in the portfolio and the possible range of outcomes under a range of scenarios.

Both risk and return are critically important and clarity around each is paramount. Experience matters.

Manager research

Investment manager research and selection is an area we have excelled at for almost thirty years. We adhere strictly to well-established and disciplined processes to evaluate and review investment managers from around the globe. Our process is multi-staged, combines quantitative and qualitative analysis and is transparent to our clients to ensure they fully understand the rigour of our evaluation. In fact, we welcome client involvement.

Once rated, we meet incumbent managers frequently, to ensure the manager is maintaining its stated style and approach, to reassess whether relative strengths have persisted and to check whether areas of concern have deteriorated. There is no set and forget for managers at Frontier and the performance of our rated managers proves the worth of our process. We have invested in technology to increase the depth and breadth of manager research to deliver value for clients.

We also use our scale and experience to help our clients in fee and mandate schedule negotiations. We have established a reputation for negotiating hard for our clients, but respecting and recognising the importance of ensuring all parties arrive at a fair outcome.

Responsible investing

Frontier Advisors believes environmental, social and governance (ESG) factors directly impact long-term investment performance. We actively incorporate responsible investment into our investment research, manager research and client advisory services. Frontier’s Responsible Investment Policy is available here.

Frontier Advisors’ Climate Change Position Statement encapsulates why we systematically consider climate change factors when supporting clients, and can be found here.

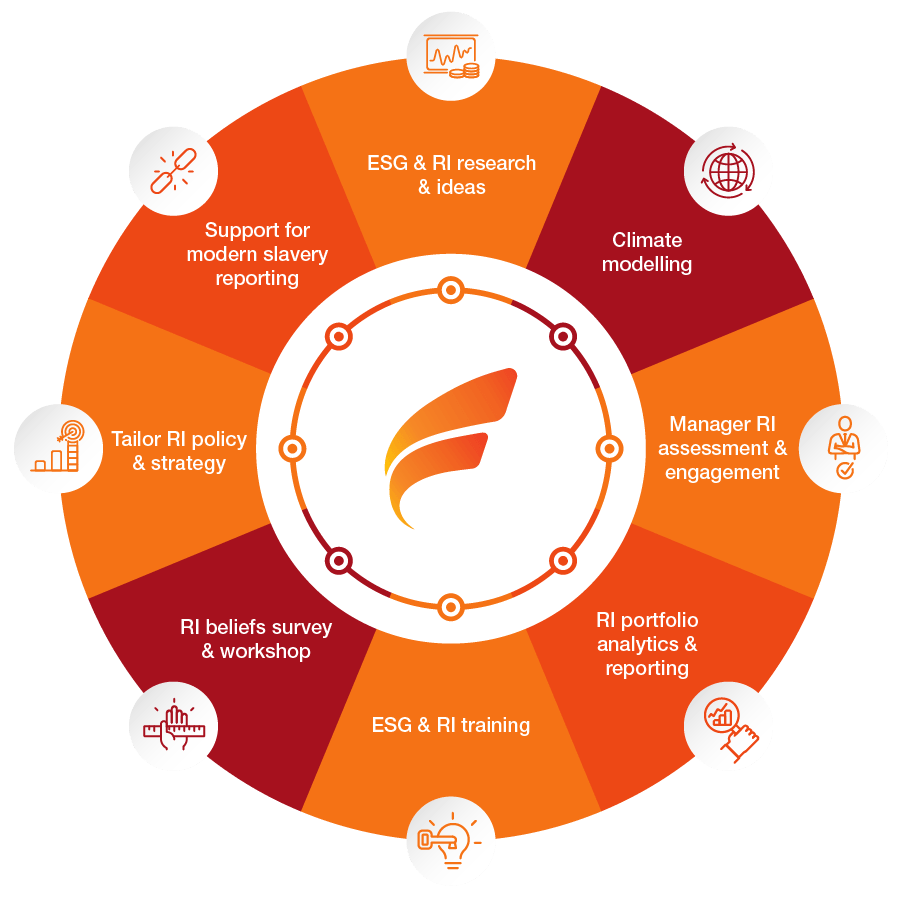

As each investor’s responsible investment needs are unique, our approach to responsible investment service is modular and covers a range of factors to help us tailor flexible solutions.

Joey Alcock leads our Responsible Investment Group. The Group includes senior representatives from Frontier’s consulting, research, investment strategy and governance functions, reflecting the integrated nature of our responsible investment approach. ESG is not an adjunct or afterthought to our traditional consulting business, but a front-line consideration.

Our Portfolio Analytics technology includes a Climate Change Module which provides an understanding of the potential impacts of climate change on investment portfolio outcomes under different potential transition scenarios.

Frontier became an early signatory of the Principles of Responsible Investment (PRI) in 2006. In accordance with PRI requirements, Frontier reports publicly on its responsible investment activities each year including the disclosure of its PRI Transparency Report (our latest report available here).

Frontier is a signatory to the Paris Pledge for Action which represents a public commitment to support the greenhouse gas reduction objectives of the Paris Agreement. Frontier is also a financial member of the Investor Group on Climate Change, supporting its efforts in helping investors to manage the impacts on their investments of the economic transition arising from climate change, and a founding member of the Net Zero Investment Consultants Initiative (NZICI). The latest report is available here.

Net Zero Investment Consultants Initiative

In 2021, Frontier was one of twelve asset consultants who were inaugural signatories to the Net Zero Investment Consultants Initiative (NZICI). NZICI is committed to supporting the goal of global net zero greenhouse gas emissions by 2050 or sooner, in line with the ambition to limit the global average temperature increase to 1.5°C above preindustrial levels. Signatories recognise significant financial risks associated with climate change and the transition to a net zero and resilient economy. These include, but are not limited to, the risk of stranded assets and loss of earnings for organisations with operations not aligned with this transition, as well as increased weather events, such as flooding, droughts or the consequences of sea level rise. Signatories have committed to support their clients on this journey. Please see our latest annual report here.

Signatory

Signatory

Member

Learn more about Responsible Investment at Frontier Advisors.

Retirement solutions

Our extensive research into retirement solutions means we can assist superannuation funds design products which better meet the needs of retirees. In understanding the risks and challenges members face, funds can take advantage of the opportunities this fundamental market shift offers.

Frontier can offer analysis and advice around member needs and behaviours; projections; product innovation and design; member engagement and communication; and aligning business objectives, evolving cash flows and investment strategy.

We believe integrating product and investment solutions will be the key for super funds to create differentiation.

Sector research

With dedicated research teams spanning a wide range of asset classes, our thought leadership, analysis of current and future risks and opportunities and ongoing review programs, help shape the portfolio construction advice we provide our clients. We complete extensive sector and configuration reviews and provide recommendations of new strategies and alternative configurations to help our clients achieve their investment objectives and find a competitive edge.

Our research teams are resourced with experienced specialists who are accessible to our clients. As well as our extensive sector specific global research developed for Australian investors, rather than off-the-shelf cookie-cutter ideas from offshore counterparts, we also complete bespoke research and analysis. You will never hear us dismiss an idea because it doesn’t suit our needs.

And of course, because we don’t sell our own products and we pass all of our best ideas and discovery on to our clients instead of keeping them for our own benefit.

Research teams

Defensives and Alternatives

Iain McMahon leads our Defensives and Alternatives Team. The Team is responsible for investment advice and manager research as it pertains to defensive assets and liquid alternatives. Defensives include cash, core fixed income, liquid credit and currency strategies; while Alternatives include absolute return strategies (in both the fixed income and multi-asset construct). These strategies typically include, but are not limited to, CTAs, global macro, and insurance linked securities. Given the breadth of the Team’s coverage, we utilise specialists from diverse backgrounds with both practical market experience and deep technical knowledge. The Team is also responsible for strategic derivatives and currency advice, which integrates our own quantitative modelling and input from Frontier’s capital markets team to ensure top-down consistency. This advice includes trade identification, strategy design and implementation via external overlay managers.

Private Markets

Andrew Kemp leads our Private Markets team. The Team is responsible for generating investment research and manager implementation across private equity and private debt segments of the market. Within private equity the team covers buyout, growth equity and venture capital strategies, whilst in private debt, direct lending, asset based lending and opportunistic/distressed credit are core areas of coverage. The Team is responsible for portfolio construction recommendations and generates investment ideas and insights by leveraging its deep manager networks and internal research specialists. The Private Markets Team also works closely with the Real Assets Team to help broaden its knowledge base and jointly cover overlapping segments of the market.

Equities

James Gunn leads our Equities Team. The Team is responsible for equities related investment and manager research across both domestic and international equities. The Team’s sector configurations incorporate our views on portfolio construction issues and developments within these asset classes. The Equities Team maintains an active research program for identifying new ideas for clients, with recent examples including climate-aligned passive equities, emerging market small caps and China A-shares research.

Real assets

Frontier is renowned for our expertise in the unlisted asset space and many of our clients were among the first to enjoy the benefits of infrastructure investment in the Australian market as far back as 1994, when Frontier Advisors first offered advice.

The Real Assets Team, led by Lucy Minichiello, encompasses specialists from diverse backgrounds, touching on areas such as real estate, infrastructure, timber, and agriculture with a blend of practical experience and technical knowledge.

Our Real Assets Analytics database provides subscribers with an unparalleled level of market data allowing strategic analysis of infrastructure portfolios.

Technology

Technology to deliver insight and power decision making

Our dedicated Technology Team develops tools and solutions built on the foundations of our investment know-how.

Our Partners Platform offers portfolio analytics, manager insights, transactions intel and governance solutions.