Global equities

As outlined in our last active management paper, the active management report card for calendar year 2024 was disappointing.

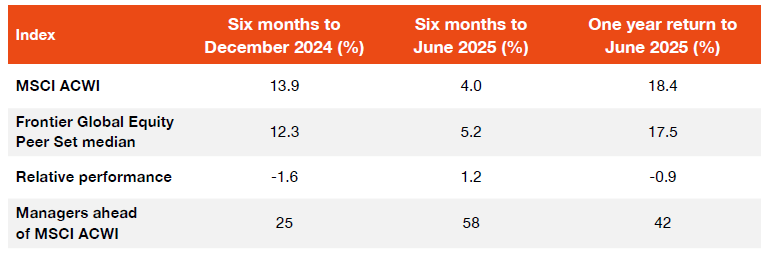

Fortunately, the first six months of 2025 have seen stronger outcomes from active management (as highlighted in our Q1 update), with the median global manager delivering 1.2% alpha against the modest returns (+4.0%) of the MSCI ACWI benchmark. Although it’s still early days, we are seeing promising signs that the tide is turning for active management and despite the incredible rebound in US growth stocks over the June quarter, 58% of managers in Frontier’s Global Peer Set were ahead of the benchmark over the first half of 2025, a welcomed uplift from 25% in the second half of 2024.

Frontier Global Equity Peer Set returns against the MSCI ACWI (AUD)

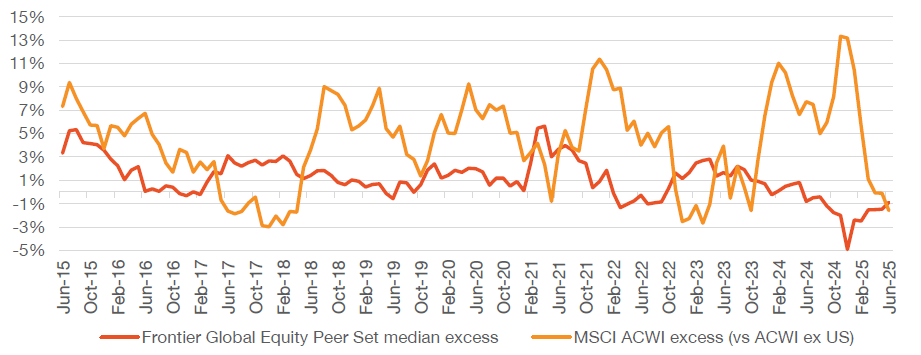

To use a well-worn cliché, the 2025 financial year was indeed a tale of two halves. The first six months were characterised by strong risk-on markets riding the wave of US exceptionalism, before geopolitical uncertainty set in and peaked during the ‘Liberation Day’ sell-off in April. The performance of US equity markets was almost a barometer for active management outcomes during the financial year, with the rotation away from the US and towards Europe in the second half allowing active managers to claw back some alpha. These dynamics can be seen in the inverse relationship over the last few years between median manager excess returns and the outperformance of the US, as shown in the chart below.

Rolling 12-month excess returns of Frontier’s Global Equity Peer Set median and the outperformance of the US

Breaking down these results across styles, growth managers outperformed value managers (+1.3% at the median level) across the first six months to December 2024, though both style cohorts failed to keep up with the broader market. The start of the 2025 calendar year then brought a strong rotation in value as cracks developed in US exceptionalism, with investors finding shelter in European cyclicals. Accordingly, value managers outperformed growth managers by 6.6% at the median level in the March quarter, until the tables turned again in the June quarter with a tech-fuelled rotation back to growth.

Australian equities

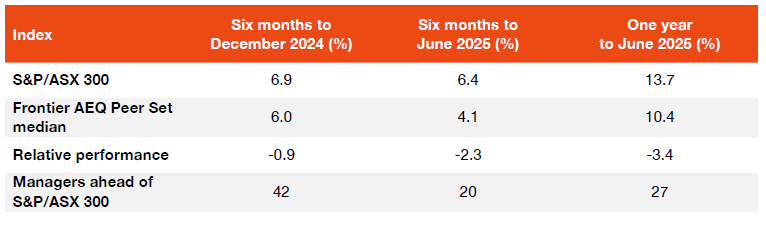

While active management outcomes have shown signs of improvement in global equities, the same can’t be said for Australian equities.

In fact, the 2025 financial year produced the worst active management outcome at the median level for Australian broad caps in more than two decades. While active managers have long been navigating concentrated benchmarks in our local market, what’s changed is the narrowness in performance drivers, with the banks and CBA in particular driving disproportionate index returns. While active managers were able to keep pace with the benchmark to start the financial year, a challenging December quarter and an even more difficult June quarter were considerable setbacks.

Frontier Australian Equity Peer Set performance against S&P/ASX 300

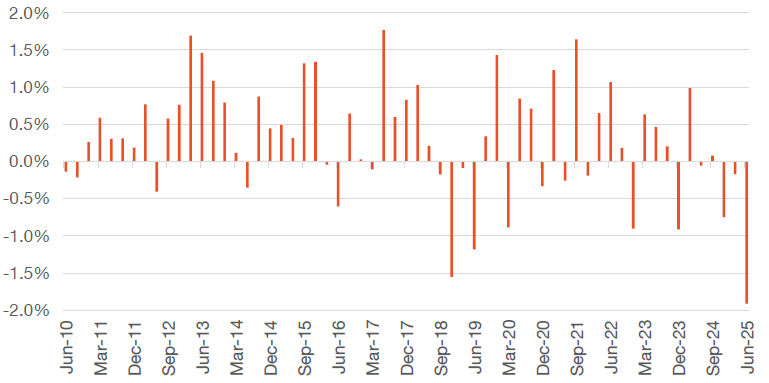

The severity of the weakness in the June quarter can be seen in the chart below, which shows quarterly median excess returns within Frontier’s Australian Equities Peer Set. The S&P/ASX 300 delivered a mighty 9.5% return in the June quarter as the index set fresh record highs. The poor active management outcomes were likely the result of typical underweight sectors outperforming (financials and REITs) while the health care sector was a notable detractor. Some high growth managers were able to overcome these headwinds through strong stock selection, with the likes of Pro Medicus, Technology One and WiseTech among the top performers over the quarter.

Australian Equity Peer Set median quarterly excess return (vs S&P/ASX 300)

The final word

Following on from 2024, which was the most significant calendar year of underperformance for active global equity managers in more than two decades, Australian equity managers were met with the same fate in FY25.

This was driven by the narrowness of market leadership, initially led by the big four banks before CBA well and truly stole the show. In contrast, global equity managers finally found some respite, with a second-half rotation away from the US being a welcome reprieve for the majority of managers who are underweight this key region. Green shoots also appeared in emerging markets in the second half of FY25 despite heightened uncertainty around tariffs.

This paper serves as a reminder to investors that active management can be cyclical. We also highlight that factors beyond traditional style biases affect performance relative to equity benchmarks. Frontier believes it is important to assess individual active management performance not only against style peers, but equally against a whole other range of factors (market breadth, country/sector leadership and size impacts) which ultimately can impact benchmark relative outcomes.

Our Equities Team is available to discuss our curated peer set service in more detail with interested clients. If you want to discuss this paper in more detail, please reach out to your consultant or a member of Frontier’s Equities Team.